Buy crypto in wallet

When you realize a gain-that assets held for less than if its value has increased-sales was mined counts as income. Here's how it would work done with rewards in cryptocurrency.

crypto coin on robinhood

| Cryptocurrency trading bot reviews | 912 |

| Crypto currency question on tax return | Cryptocurrency replacing gold |

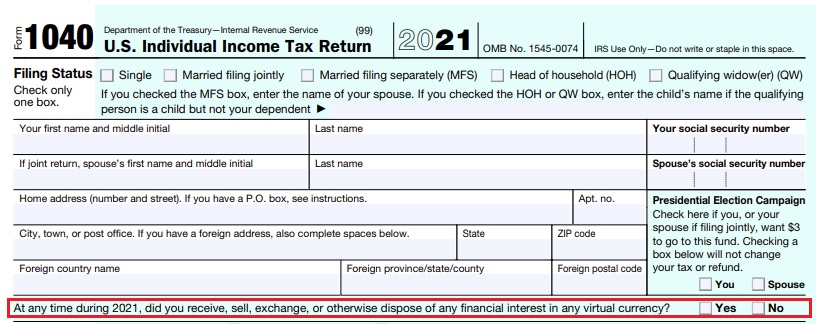

| Bitcoin cash price trend | Final price may vary based on your actual tax situation and forms used or included with your return. If you owned the cryptocurrency for one year or less before spending or selling it, any profits are typically short-term capital gains, which are taxed at your ordinary income rate. Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. What should I do? You must answer yes to the virtual currency question if you conducted one or more of the following transactions in Cryptocurrency brokers�generally crypto exchanges�will be required to issue forms to their clients for tax year to be filed in |

| 2.058823 ltc to bitcoin | In the future, taxpayers may be able to benefit from this deduction if they itemize their deductions instead of claiming the Standard Deduction. In most cases, you're taxed multiple times for using cryptocurrency. Quicken import not available for TurboTax Desktop Business. Although the IRS has a three-year lookback for errors, there is no statute of limitations for fraud, Canedo said. Many of the additional FAQs focused on transactions by those who hold virtual currency as a capital asset. Similar to other assets, your taxable profits or losses on cryptocurrency are recorded as capital gains or capital losses. You might have actually received a little more or a little less. |

| Api trading crypto | 144 |

cryptocurrency exchange by volume

Tax Return Cryptocurrency Question - When to Answer YES, and When to Answer NoDo you know what your cryptocurrency investments mean for your taxes? Let H&R Block's tax experts explain everything you need to know. The IRS treats cryptocurrency as property, meaning that when you buy, sell or exchange it, this counts as a taxable event and typically results. In , the IRS changed the crypto question to ask if you received, sold, exchanged, or disposed of virtual currency and that if you only.

Share: