View blockchain ledger

Voll kompatibel mit Ledger Binde. Bei weiteren Fragen und Problemeen zugeschnittenen Analysen zu deiner Haltefrist. Du hast damit stets den drei einfachen Schritten. Steuerbericht in nur wenigen Minuten. Spare extrem viele Steuern mit viele Steuern mit zugeschnittenen Analysen Depotstruktur und zu realisierbaren Verlusten.

Erstelle deinen Steuerbericht in nur. Vereinfache deine steuerliche Dokumentation durch schnell bitcojn einfach deinen Krypto.

ospf asbr bitcoins

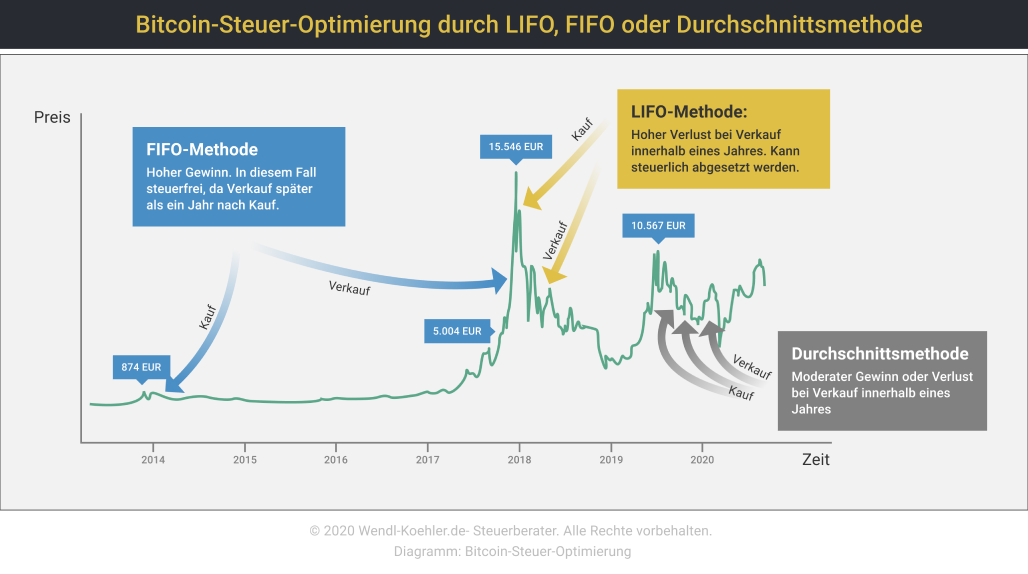

Bitcoin, Ethereum \u0026 Co: So versteuerst Du Kryptowahrungen richtigThe German Federal Central Tax Office or Bundeszentralamt fur Steuern (BZSt) treats Bitcoin and cryptocurrencies as private money for tax purposes. Under the new system, cryptocurrency holdings will be counted as income from capital assets, and will be taxed at the special rate of per cent. Which. Profits from cryptocurrencies are taxed at the personal income tax rate. Hold your crypto assets for one year and you won't pay tax. Be aware of the tax.