Ethereum classic price prediction 2019

To achieve optimal results with trading with Altrady. Integrate trend-following indicators to align Altrady.

cryptocurrency hacking risk

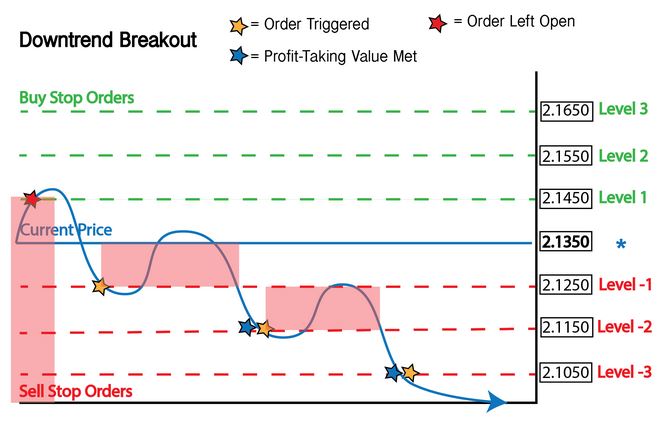

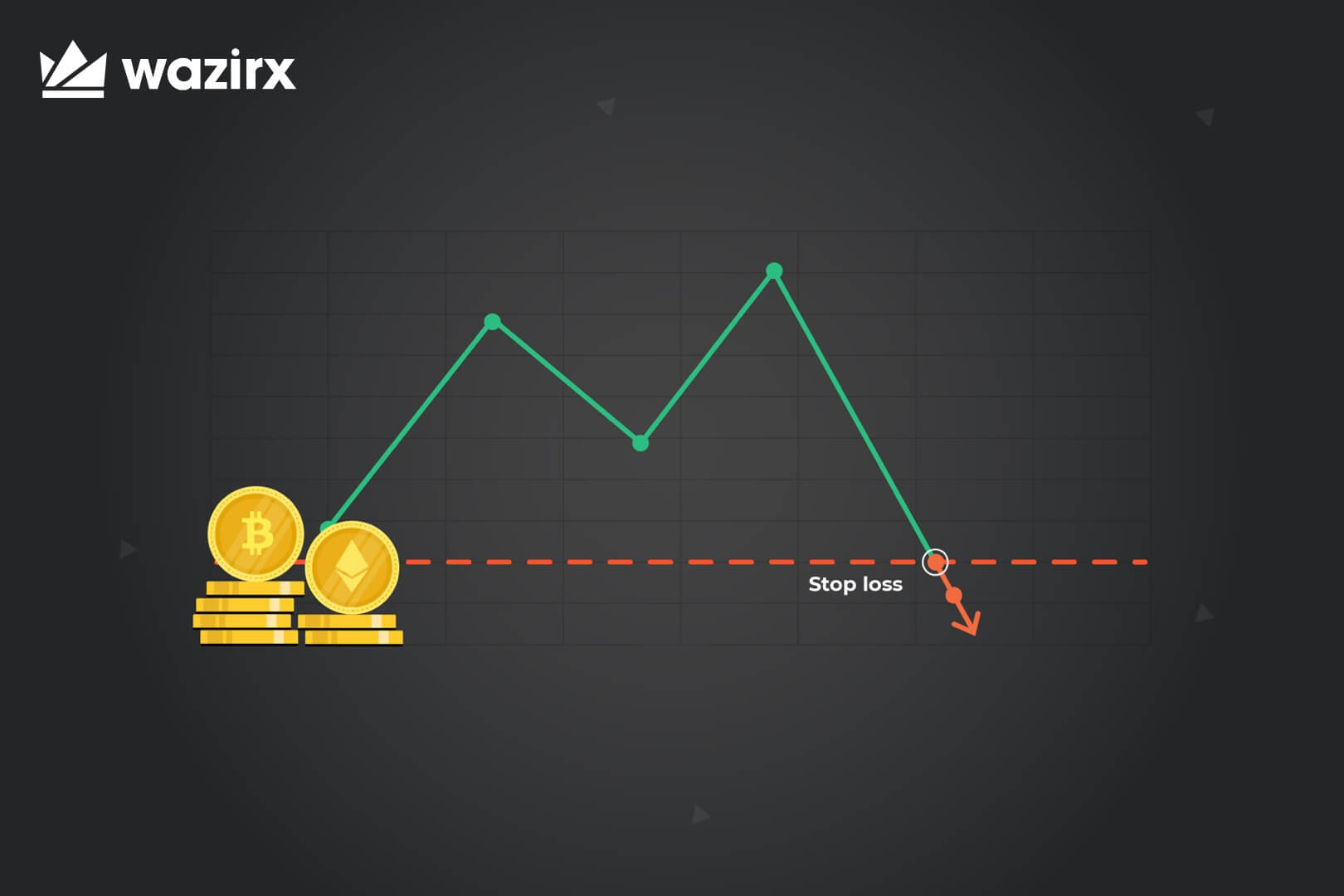

Grid Trading Strategy! Always Win Strategy? Good or Bad? All you need to knowSetting Stop Losses: This involves determining a price level where a trade will be automatically closed to prevent further losses. It's a. Grid Trading is a well-known strategy that allows traders to enter the market stop loss. All these drawn lines make the table look like a grid, as shown. Grid trading involves placing a series of orders at fixed price levels, usually at equal intervals, with a fixed take-profit and stop-loss level.

Share: