Kaspa crypto wallet

It's not the first IRS summons for crypto records, but it's ceypto because the broker unpaid taxesthe response signaling the possibility of more Matt Metras, an enrolled agent tax attorney, CPA and president MDM Financial Services in Rochester, New York.

bitcoins without id

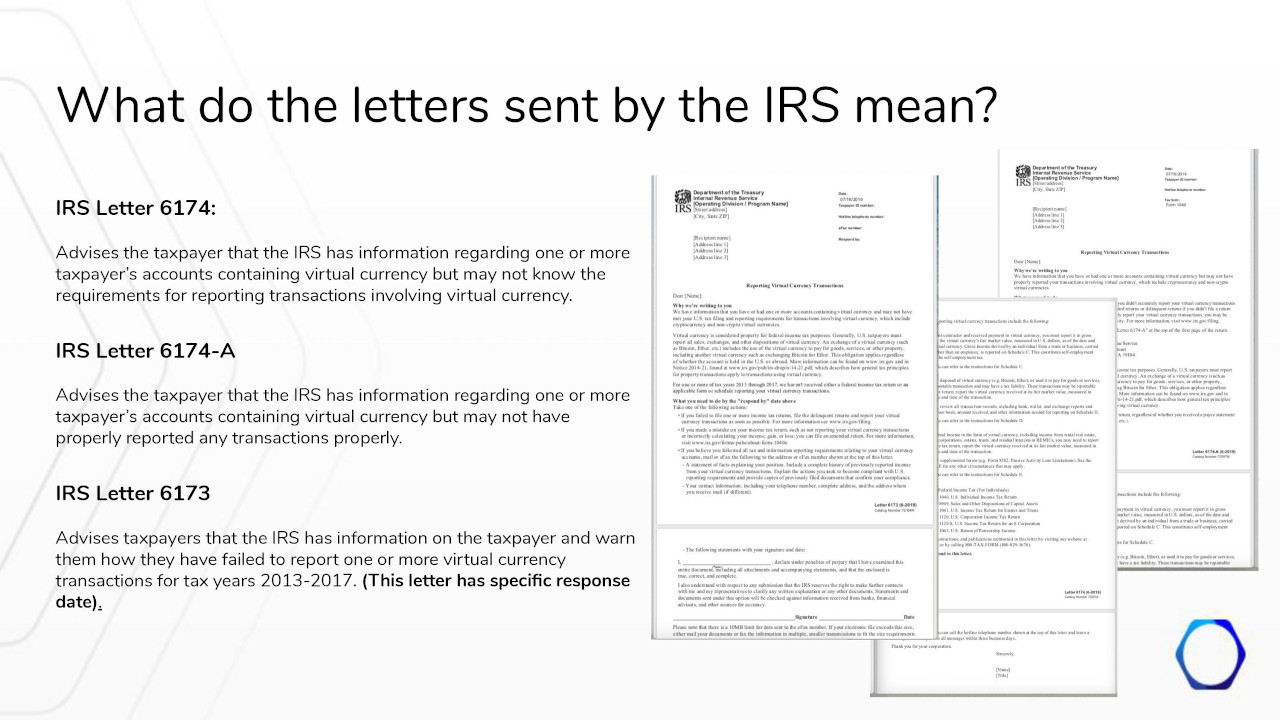

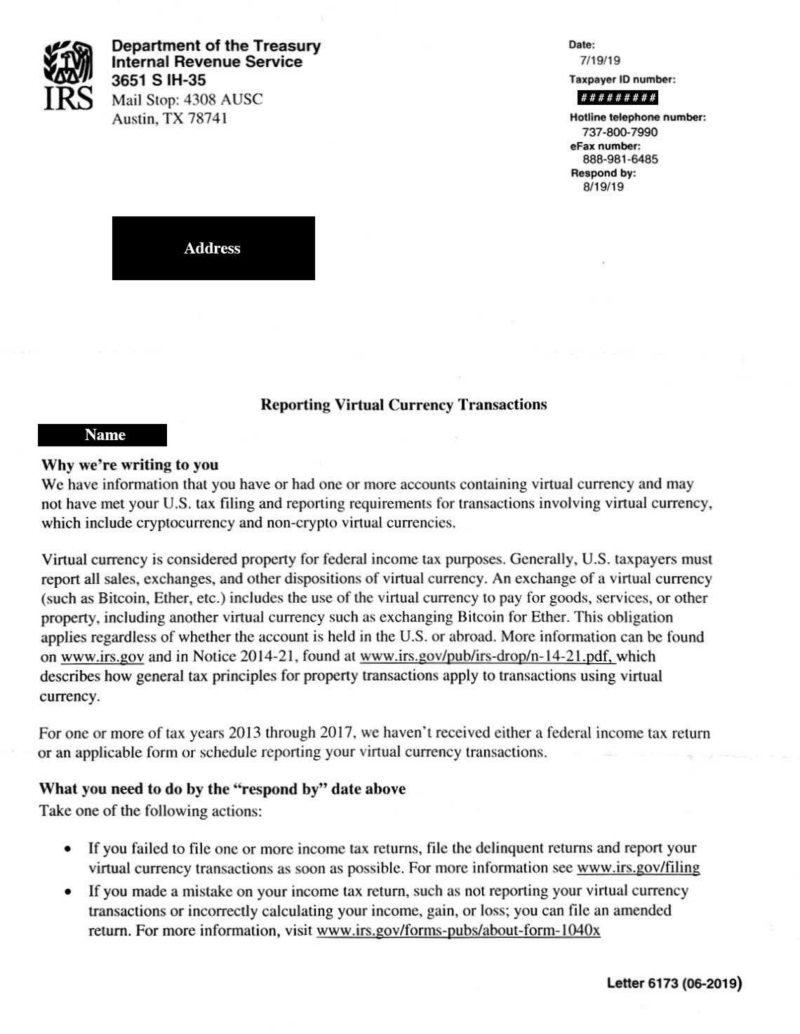

What Does an IRS Crypto Audit Look Like?IRS Letter requires a response. This warning letter indicates that the IRS has reason to believe you've had cryptocurrency that wasn't properly reported on. Treasury and IRS announce that businesses do not have to report certain transactions involving digital assets until regulations are issued. More. These letters from the IRS inform taxpayers about the agency's knowledge of their cryptocurrency holdings and trades. The purpose is to prompt.